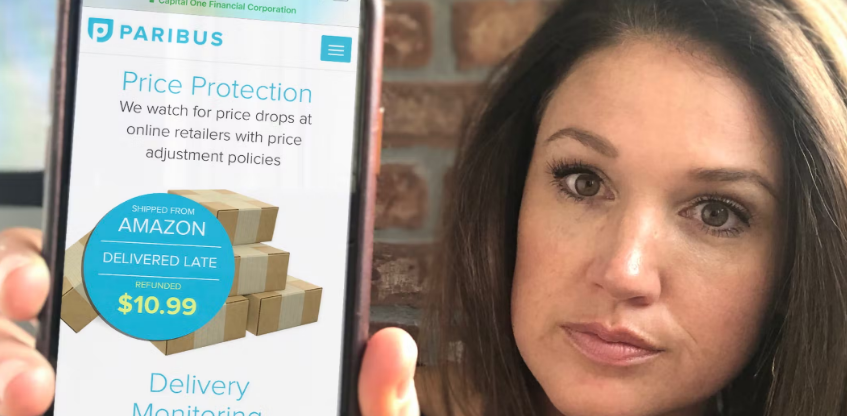

By allowing customers to receive automatic refunds as prices drop on their purchases, Paribus has revolutionized the concept of consumer savings.

Paribus searches your emails for transaction receipts as part of the reimbursement process. Many brick-and-mortar establishments will send you a receipt through email instead of printing one for you since most transactions now require the use of an email address to validate the transaction.

By monitoring its users' transactions, Paribus gives them discounts from the more than internet businesses it tracks rather than just acting as a search engine. Customers have used the company for free since Capital One Financial Corp. purchased it in 2016. (COF).

Manufacturing and selling Paribus

When Eric Glyman and Karim Atiyeh founded Paribus in 2014, they saw that most merchants had systems to refund clients if a product's price decreased after they had purchased it. Customers without access to cutting-edge technologies still face an uphill battle in an age where complex data systems and algorithms determine what you see online.

It's nearly impossible for people to keep track of pricing increases. As a result, they are reluctant to contact the retailer to request a refund, even if the situation is urgent.

Some consumers opt to use their credit card issuers as an alternative to Paribus if they are still unsure of the model. In rare cases, advertisements for price change reimbursements can be discovered. Credit card companies often want proof of the price modification and a claim.

Managing Your Money and Raising Money

Using Paribus, you can scan your email inbox to keep track of all your internet purchases. When a receipt is reviewed and processed into the system, the data is identified, assessed, and stored in a database. This is the most significant piece of information: the price you paid. If the product's price reduces during the refund period, Paribus will request a refund on your behalf.

At the time, financial services company Paribus said it would acquire Paribus's technology and employees. Public access to financial information concerning Paribus's performance has been restricted.

Before it was acquired by Capital One in 2016, Paribus kept a quarter of all rebates. They are no longer holding any of the rebates that they earn. Therefore, they are now offering their service to customers for free. People tend to be skeptical of the business strategy of companies that provide free services.

The revenue generated by Paribus comes from the targeted advertisements on its user interfaces. According to Paribus' privacy policy, the company does not share or advertise the personal information of its users with third parties.

History and Leadership

Two Harvard grads, Eric Glyman and Karim Atiyeh founded Paribus in 2014. In 2015, it made its premiere at TechCrunch Disrupt New York, a technology conference in New York City. It had a 12-person team at the time of acquisition, all of whom joined Capital One. The new parent company has upgraded the two founders to "Senior Directors in U.S. Card."

The startup's request for excessive personal information is a trade-off for specific clients. For commission fees, Paribus demands access to your email account and, in some cases, your credit card details. Paribus users who are hesitant to reveal their shopping habits should weigh the benefits and drawbacks of using the service before deciding whether or not it is worth it. So, if the savings from sharing their personal information outweigh the danger, they can make that decision.

The Most Recent Modifications

It's been challenging to stay on top of new developments since Capital One acquired Paribus. When the bank received Paribus, it was part of a larger group of financial instruments, including CreditWise and Second Look. Also rumored to be in the credit card price protection business was Paribus, which Capital One was already working on.

Paribus' service is more important than ever as more retail sales move online. Since the rise of internet marketing, price tampering has become widespread. Certain websites can boost prices after they've been visited to deceive customers into spending more money. A wide range of factors, such as supply and demand, are factored into dynamic pricing algorithms. Consider Amazon.com's notoriously volatile price, which makes it the world's most popular online store. Because so few people have the inclination or the time to maintain tabs on this fluctuating cost, many internet stores use dynamic pricing.

Paribus has both advantages and disadvantages.

Taking back from the large businesses, Paribus has positioned itself as a "small person." A similar method is used by retailers who use software to produce automatic pricing changes. Paribus' software uses data analysis to adjust retail prices, but when it identifies an increase or decrease in a retail price, it immediately sends the merchant a refund request.

Because of this, Paribus will continue to focus on strengthening its ability to track pricing changes and process rebate applications on behalf of clients while also attempting to grow its customer base. There have been no indicators of the company's approach shifting since switching to a free model in 2016.