With their three variations, Triangle patterns are one of the most common daily trading patterns you must keep an eye on. These patterns are significant because of several factors that show a reduction in volatility, which could later grow again. Triangles can provide information about current conditions and offer indicators of situations that could be coming. Triangle patterns also provide trading opportunities while it forms and after completion.

A thorough understanding of these three forms will allow you to create breakout or anticipation strategies you can employ in your trading day-to-day, helping you manage the risk and size of your position.

Symmetrical Triangle

A symmetrical triangular pattern occurs when the upward and downward fluctuations of the price of an asset are limited to an area that shrinks and grows in time. A move upwards isn't as high as the previous move up, while an inverse move doesn't make it as low as the previous one. Price movements are creating lower swing highs as well as smaller swing lows.

Connecting the highs of the swings by a trendline and the lows of the swing by using a trendline will create a symmetric triangle in which the two trendlines are advancing towards one another. The triangle is drawn after two swing highs, and two lows could be connected with the help of a trendline. Because the price can fluctuate up and down in a triangular pattern several times, traders usually wait until the price forms three swing lows or highs before creating the trendlines.

Ascending Triangle

Rising lows can create an ascending triangle in swings and swing highs at the same price. If a trendline is drawn through the comparable highs in the swings, it forms a horizontal line. The trendline that connects the swing lows rising is inclined upwards to form an ascending triangle.

The price is restricted to an increasingly smaller area but reaches the same high every time the low is moved upwards. An ascending triangle is drawn after two highs from swings, and a trendline can join two lows.

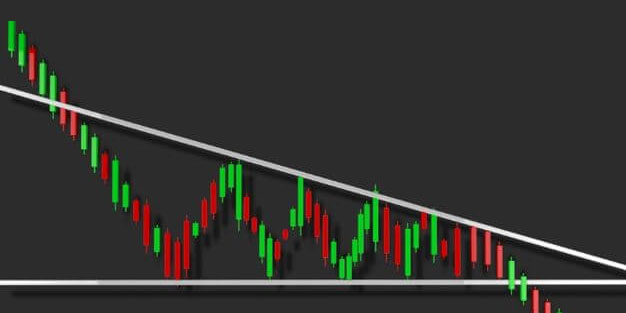

Descending Triangle

A descending triangle can be formed by constantly lowering the highs of the swing over time, as well as swing lows that attain similar levels to those of the previous lows. If a trendline is traced across the same lows of swings creating the appearance of a horizontal line. The line connecting to the fall's highs is bent downward, creating a descending triangle.

The price is confined to an ever smaller and smaller space; however, it is hitting a similar low with each step-down. A descending triangle is drawn when two highs from swings and two lows in swings can be linked with the trendline. In real life, when the two components are joined, the trendline might not perfectly connect the lows and highs. This is fine; draw trendlines that fit the price movement.

Breakout Strategy

The breakout technique can be applied to any type of triangle. The method of execution is the same no matter which type of triangle you are using, whether it is ascending or descending, or symmetrical.

The strategy to break out is to buy whenever prices of assets rise over the upper trendline of an arc or to shorter sell (sell the asset before when it reaches a lower cost and then plan to buy it back later at a lower price) when the value of an asset is to below that lower line of a trend of the triangle.

Since every trader can draw their trendlines differently and the exact point of entry can differ among traders. To identify when the price is breaking through the resistance or support levels, watching for an increase in volume could assist in determining if prices are beginning to accelerate toward the possibility of a breakout. The purpose of the burst method is to make profits when prices are moving off from the trends that form the triangle.

Anticipation Strategy

Advanced versions that use this strategy include predicting whether the triangular shape will be held and anticipating the possible breakout direction. If you assume that the triangular shape will be held and anticipate the potential breakout's path, the traders can often discover trades with a high reward potential about risk.

For example, suppose a triangle formation occurs, and a trader believes it will eventually move towards the upside. In this scenario, you can purchase close support for the triangle (the lowest point) and not wait for the breakout. This will create an entry point that is lower for trading. By buying close to the lower end of the triangle, the trader also receives a more favorable cost.