In the Vanguard S&''P 500 ETF, the largest corporations in the United States are invested. To mirror the S&''P 500 index, VOO is an exchange-traded fund that owns all of the stocks in the S&''P 500. The S&''P 500's return on investment is used as an indicator of the broader stock market in the United States.

For example, the S&''P 500 index is a hypothetical collection of stocks and other investments representing a part of the whole market. These broad-based indexes include the S&''P 500 and the Dow Jones Industrial Average.

Understanding the Vanguard S&''P 500 ETF (VOO)

One hundred and fifty of the most prominent American corporations are included in the S&''P 500 index. The Vanguard S&''P 500 ETF is designed to mimic the S&''P 500 index's performance. Investors like VOO because it's well-diversified and made up of large-cap stocks, which are shares of massive firms. Compared to smaller firms, large-cap stocks are more stable and have a long history of success. The risk of loss can be mitigated but not eliminated by the fund's wide-ranging, well-diversified stock selection.

Diversification of Investments

Many mutual funds can offer equities from a wide range of industries. It's common to see a sector as an umbrella term for businesses all engaged in the same activity, such as selling the same product. For example, the consumer basics sector includes commodities such as toilet paper, whereas the consumer discretionary sector includes items such as jewelry and other luxuries. The Vanguard S&''P 500 ETF's various sectors' weighting is shown in the right table.

Vanguard S&''P 500 ETF Investing

Because ETFs are traded like regular stocks, you may buy or sell them anytime during trading hours. Your broker-dealer or an investing app like Robinhood can help you buy Vanguard S&''P 500 ETF shares. When purchasing fractional ETF shares, you can give a dollar value for the buy order. Most broker-dealers and applications do not charge purchase commission costs. However, opening a brokerage account with the fund provider, Vanguard, via its website is a specific method to avoid incurring commission costs.

The Risk of Loss from Dangerous Theories

Take, for example, the mid-2000s real estate boom. Many people believed that land was a scarce commodity. Because this idea would constrain supply, demand and prices would rise with it. Unfortunately, due in part to lax lending policies, many investors were unprepared for the looming real estate catastrophe that caused the 2008 financial crisis. Similarly, when it comes to investing in U.S. equities, it may seem like that's the only place to put your money. Additionally, many investors believe that if everyone is invested in U.S. shares, the stock market price will keep rising.

Precious Dollars

The Vanguard S&''P 500 ETF is a low-cost, low-maintenance vehicle that gives investors access to the U.S. stock markets. Risk tolerance is a term used to describe the degree of risk an investor is ready to accept while investing. How long money will be invested in a market is also crucial.

Time Horizon and Risk Tolerance

Younger investors can make up for investment losses from market declines with a long time frame to make up for their losses in the stock markets. However, individuals nearing or have already reached retirement age may want to place their money in lower-risk investments. If you're looking for a haven, consider investing in U.S. Treasury bonds or bills. Treasuries are risk-free investments because the U.S. Treasury backs them, notwithstanding their low-interest yields.

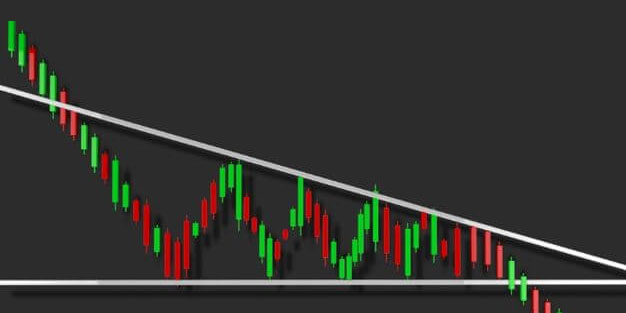

Increasing and Declining Costs

For those worried about an economy experiencing deflation, some investors may opt to keep their cash on hand. Deflation raises the dollar's purchasing power, which may seem contradictory. Inflation, on the other hand, is something that some investors may be concerned about. As a result, investors may buy stock, such as the Vanguard S&''P 500 ETF, hoping to see a return more significant than the inflation rate.

Will The Vanguard S&''P 500 (VOO) ETF Split?

When it comes to VOO, there has only been one split throughout its history. During a period of decline, it happened on October 24, 2013. As a result of the 1-for-2 reverse split, every two shares owned by investors were united into a single share. The ETF's price increased due to the reverse split, which decreased the number of shares in circulation. In addition, it narrowed the margin between the price paid for shares and the price received for them, which benefited investors.

Summary

It is possible to invest passively in the S&''P 500 by purchasing the Vanguard S&''P 500 ETF. To put it another way, the fund's management staff does not engage in active stock trading, which keeps the expense ratio low. It's easy to get a foot in the door of the U.S. equity market by investing in Vanguard's VOO. The Vanguard S&''P 500 ETF has some risks, and investors should speak with a financial advisor before purchasing.